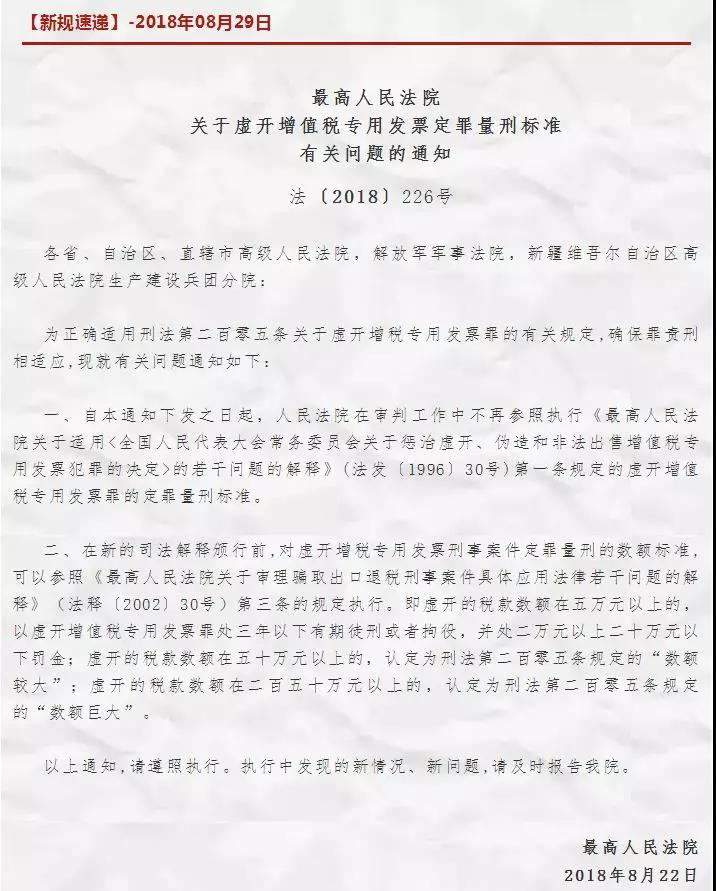

2018August 22 ,The Supreme People's Court issued a notice on issues related to the conviction and sentencing standards for false issuance of special VAT invoices。The notice is as follows:

The full text of the notice is as follows:

Provinces、Autonomous regions、The High People's Court of the Municipality directly under the Central,PLA Military Court,Xinjiang Uygur Autonomous Region High People's Court Production and Construction Corps Branch:

In order to correctly apply the relevant provisions of Article 205 of the Criminal Law on the crime of falsely issuing special VAT invoices,Ensure that the punishment is proportionate,The relevant issues are hereby notified as follows:

One、From the date of issuance of this notice,The people's courts are no longer to refer to the implementation of the "Supreme People's Court's Ruling on Application" in their adjudication work<The Standing Committee of the National People's Congress on the punishment of false openings、Decision on the crime of forging and illegally selling special VAT invoices>Explanation of some issues》(Fafa[1996]30number)The conviction and sentencing standards for the crime of falsely issuing special VAT invoices as provided for in Article 1。

Two、Before the promulgation of the new judicial interpretation,The amount of conviction and sentencing standards for criminal cases of false issuance of special VAT invoices,Refer to the "Interpretation of the Supreme People's Court on Several Issues Concerning the Specific Application of Law in the Trial of Criminal Cases of Fraudulent Export Tax Rebates"(Legal Interpretation[2002]30number)The provisions of Article 3 shall be implemented,namelyThe amount of tax falsely issued is more than 50,000 yuan,The crime of falsely issuing special VAT invoices shall be sentenced to fixed-term imprisonment of not more than three years or short-term detention,and a fine of between 20,000 and 200,000 RMB;The amount of tax falsely issued is more than 500,000 yuan,It is found to be a "relatively large amount" as provided for in article 205 of the Criminal Law;The amount of tax falsely issued is more than 2.5 million yuan,It is found to be "a huge amount" as provided for in Article 205 of the Criminal Law”。

The above notice,Please follow suit。New situations found in the implementation、New questions,Please report to our hospital in time。

Supreme People's Court

2018August 22

What is fictitious invoicing? Let's take a few simple examples:

No real trading takes place,but invoiced,This is a false opening;

It's apples that sell,The invoice is oranges,This is a false opening;

Sold 3 apples,The invoice was for 2 apples,This is a false opening;

The apples sold are 5 yuan a pound,The invoice is 7 yuan a catty,This is a false opening;

The thing was sold to A,The invoice was issued to B,This is a false opening;

A sells something to B,The invoice was issued by C to B,This is a false opening。

Company A pays tax evasion,The legal representative of Company A asked a friend to be the legal representative, and Company B issued invoices for Company A without actual transactions。Over here,Both Company A and Company B are guilty of false invoicing。

There is another case,False invoicing by financial intermediaries ,One is professional,That is, as a way to make money。Acts as a "broker" between the biller and the drawee,Earn intermediary fees,This is a violation of the law;

The other is businesses that happen to know that they have excess invoices and those that lack them。With the idea of doing a favor to a friend, I became an introducer,This kind of behavior is mostly caused by ignorance of the law。

It doesn't matter if you know the law or not,Is there a benefit fee?,Once these behaviors occur,It must be punished by law,therefore,Business owners are paying real attention to these aspects,lest good intentions do bad things,Hurt others and hurt yourself。

This article originates from the SME Service Express,If there is any inconvenience or impact,Please contact us,We will take down this article as soon as possible。